Quickbooks Tax Line Mapping Bank Account. You should have bank account in QuickBooks for each bank account your business has (this includes PayPal). This account receives payments (direct deposit (ACH), checks, etc.) and sends out money (payments to vendors, suppliers, partners, etc.) SOLVED•by QuickBooks•QuickBooks Accountant Online•.

Managing a business requires a considerable amount of effort and time.

Step by step QuickBooks Online Banking transactions tutorial.

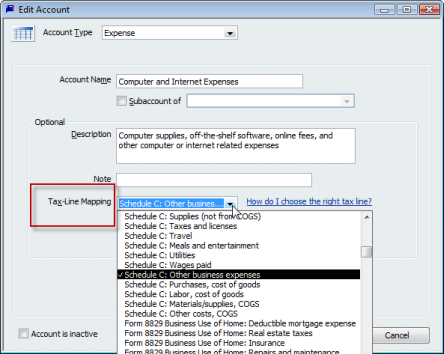

QuickBooks designed to ease the business accounting operations, sometimes is at risk of plenty of errors and problems. one in all the common problems Tax-Line Mapping: this can be helpful if you plan on group action with TurboTax for Business. Go to the "Tax-Line Mapping" screen or menu in QuickBooks and select the tax form you want to use. So if you open a new one, you'll need to add it to your QuickBooks chart of Tax-Line Mapping: This can be useful if you plan on integrating with TurboTax for Business.