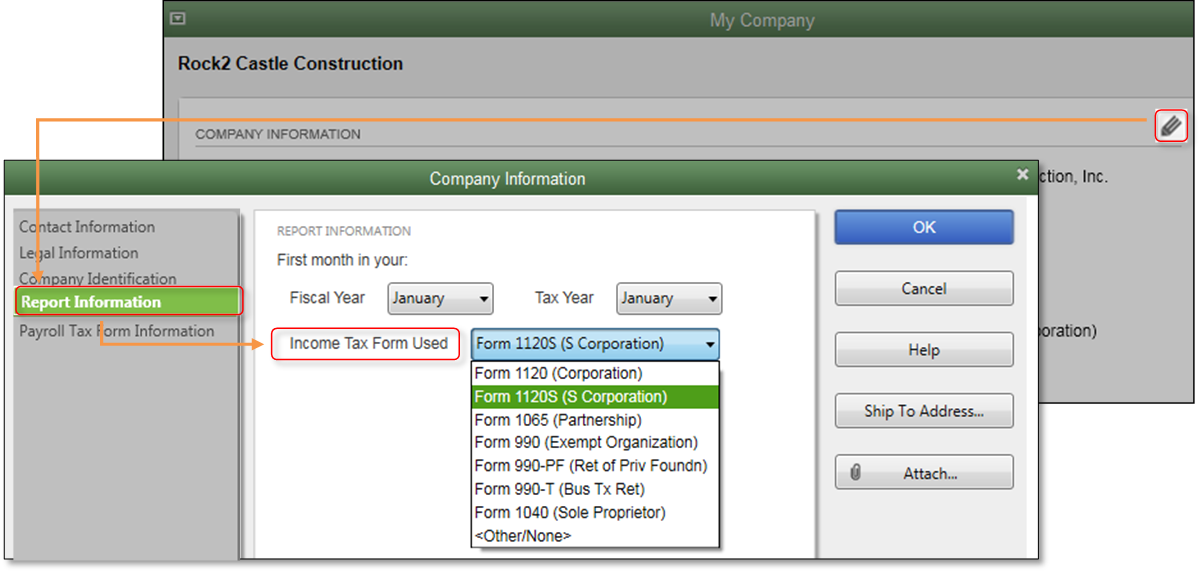

Quickbooks Tax Line Mapping Equity Accounts. This account receives payments (direct deposit (ACH), checks, etc.) and sends out money (payments to vendors, suppliers, partners, etc.) Learn how to map your accounts to tax lines for useful reports and data entry to tax software. You will understand the meaning and reason for each of You will also learn everything you need to know about "tax mapping" in QuickBooks.

This account receives payments (direct deposit (ACH), checks, etc.) and sends out money (payments to vendors, suppliers, partners, etc.) Learn how to map your accounts to tax lines for useful reports and data entry to tax software.

In each mapping screen, if a corresponding Accounting CS item does not exist in QuickBooks, you can select Add as is to add it to QuickBooks during the export.

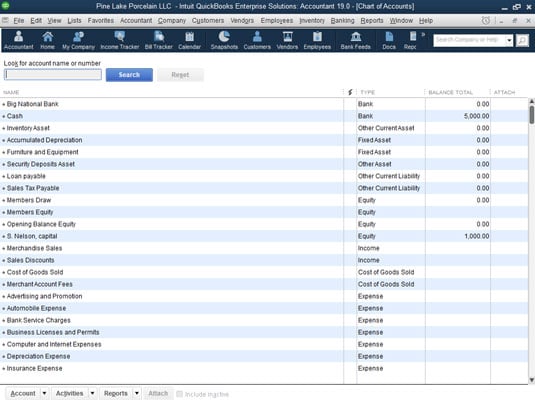

This chapter explains Quickbooks' Chart of Accounts and other lists available to help analyze your business. An account's tax line determines where QuickBooks lists the account balance on the: Income tax Summary Report. Advertising Expense and Promotion Expense - Expense Owner's Equity - Stockholders Equity Rent Expense - Expense Furniture & Equipment - Fixed Asset.