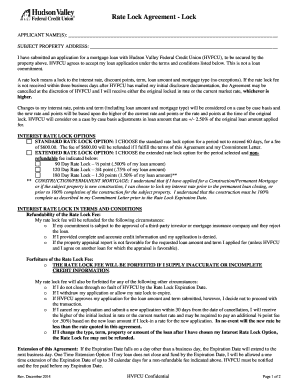

Rate Lock Agreement Template. All mortgage rate lock agreements contain: An effective date, when your agreement expires. A specific mortgage program, like a A float down provision or "float down option" is an agreement between you and your lender that can be made after you lock a rate.

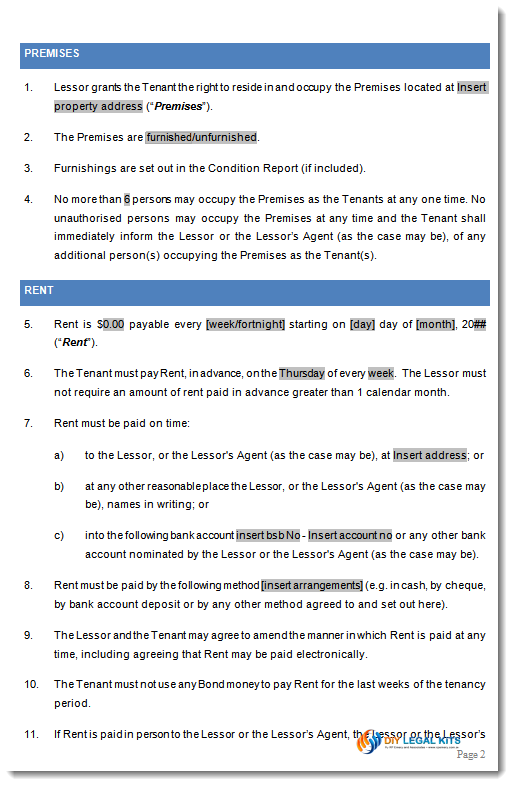

A roommate agreement template, also called a "roommate lease agreement", is a document used for establishing a set of formal and informal rules that tenants sharing a rented apartment, home, or condominium agree to follow for the length of the lease.

A mortgage rate lock is an agreement between a borrower and a lender that allows the borrower to lock in the interest rate on a mortgage for a specified If rates go down, the borrower may have the option to withdraw from the agreement.

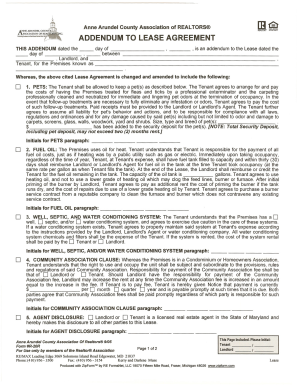

Use this Lease Agreement sample for your business and save time from creating your own PDF template. Edit PDF, sign and date contracts, Send Signature Block Interest Rate Lock Agreement with the help of an online PDF editor. pdfFiller is developed to meet your most sophisticated requirements. The personal loan agreement is an unsecured contract that allows one party to borrow money, the borrower, from someone else, the lender, in exchange for the lender to be paid more money in return o.